Roofing Financing Options in Granite Hills, CA

Roofing Financing Options in Granite Hills, CA

Understanding Roofing Financing in Granite Hills

When it comes to roofing projects in Granite Hills, CA, understanding your financing options is crucial. Homeowners often face the challenge of unexpected roofing repairs or replacements, especially given the region’s unique climate, which can lead to wear and tear on roofs. Fortunately, there are various roofing financing options available that can help alleviate the financial burden of these necessary improvements.

Financing your roofing project not only allows you to manage costs more effectively but also ensures that you can address urgent repairs without delay. By spreading the cost over time, you can maintain the integrity of your home while avoiding the stress of a large upfront payment. This is particularly important in Granite Hills, where the local weather can lead to issues such as thermal expansion and contraction, causing cracks and leaks if not addressed promptly. How financing impacts your roofing investment can provide further insights into the long-term benefits of investing in quality roofing solutions.

Cal Roof’s Commitment to Accessible Roofing Solutions

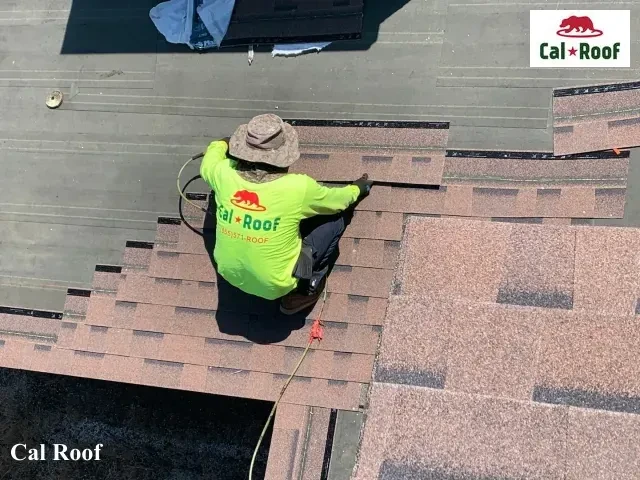

At Cal Roof, we understand that quality roofing should be accessible to all Granite Hills residents. Our approach to making roofing affordable includes tailored roofing financing services designed to meet the specific needs of our community. We take into account the unique challenges faced by homeowners in the area, such as the potential for pest-related damage or the need for materials that can withstand local weather conditions.

Transparency is at the heart of our financing process. We ensure that our clients fully understand the terms and conditions of their financing options, allowing them to make informed decisions. Our goal is to provide not just a roof over your head, but peace of mind knowing that your investment is secure and manageable. With Cal Roof, you can rest assured that your roofing needs will be met with professionalism and care, tailored specifically for the Granite Hills community.

Exploring Financing Options for Your Roofing Project

When it comes to roofing projects in Granite Hills, CA, understanding your financing options is crucial. With the unique climate and local regulations affecting roofing materials and installation, having a solid financial plan can make all the difference. Whether you’re considering a new roof installation or a replacement, exploring various financing avenues can help you manage costs effectively.

Traditional Bank Loans for Roofing

Traditional bank loans are a common choice for homeowners looking to finance their roofing projects. These loans typically offer fixed interest rates and predictable monthly payments, making budgeting easier. However, qualifying for a bank loan in Granite Hills can be competitive. Lenders often look for a good credit score, stable income, and a low debt-to-income ratio. To secure the best interest rates, consider improving your credit score before applying and shop around for different lenders to compare offers.

Home Equity Lines of Credit (HELOC) for Roof Financing

For many Granite Hills homeowners, a Home Equity Line of Credit (HELOC) can be an attractive option. By leveraging the equity in your home, you can access funds for your roofing project at potentially lower interest rates than traditional loans. One of the significant advantages of a HELOC is its flexibility; you can borrow only what you need and pay interest only on the amount used. Additionally, the interest on a HELOC may be tax-deductible, providing further financial relief. However, it’s essential to understand the risks involved, as your home serves as collateral.

FHA Title I Home Improvement Loans

FHA Title I Home Improvement Loans are another viable financing option for Granite Hills residents. These loans are designed specifically for home improvements, including roofing projects, and do not require equity in your home. Eligibility criteria are relatively lenient, making it easier for homeowners to qualify. Title I loans can cover a significant portion of your roofing costs, allowing you to invest in quality materials and workmanship without the burden of upfront payments. This can be particularly beneficial in a community like Granite Hills, where maintaining the aesthetic and structural integrity of homes is essential.

By understanding these financing options, you can make informed decisions that align with your budget and roofing needs. Whether you choose a traditional bank loan, a HELOC, or an FHA Title I loan, having a clear financial strategy will help ensure your roofing project is a success.

Specialized Roofing Financing Services in Granite Hills

When it comes to roofing projects in Granite Hills, CA, understanding your financing options can make all the difference. At Cal Roof, we recognize that investing in a new roof or a replacement can be a significant financial commitment. That’s why we offer specialized roofing financing services tailored to meet the unique needs of our local community.

Contractor-Facilitated Financing Programs

Cal Roof has established strong partnerships with local financial institutions to provide our clients with accessible financing solutions. Our contractor-facilitated financing programs are designed to simplify the process, ensuring that you can focus on what matters most—your roofing project. With a streamlined application process, we aim for quick approvals, allowing you to get started on your roofing needs without unnecessary delays. Our flexible terms are specifically crafted for roofing projects, accommodating various budgets and timelines.

Low-Interest and Deferred Payment Options

In Granite Hills, homeowners often seek ways to manage their expenses effectively, especially when it comes to significant investments like roofing. We offer low-interest options, including 0% interest introductory periods, which can help you save money while ensuring your home remains protected. Additionally, our deferred payment plans allow you to start your roofing project without immediate financial strain. By understanding these options, you can maximize your savings and make informed decisions that align with your financial goals.

At Cal Roof, we are committed to providing not just exceptional roofing services but also the financial support you need to make your project a reality. Our local expertise ensures that we understand the specific challenges faced by Granite Hills residents, from navigating local building codes to addressing the unique climate considerations that can impact roofing materials and installation. Trust us to guide you through the financing process, making your roofing dreams achievable and stress-free.

Navigating the Roofing Financing Process

When it comes to roofing projects in Granite Hills, CA, understanding the financing options available can make a significant difference in your overall investment. With the unique climate and local regulations affecting roofing choices, it’s essential to navigate the financing process effectively to ensure you get the best value for your money.

Steps to Finance Your Roofing Project in Granite Hills

-

Initial Roof Assessment and Project Scoping: The first step in financing your roofing project is to conduct a thorough assessment of your current roof. This involves evaluating its condition, identifying any necessary repairs, and determining the scope of the project. As a local contractor, we understand the specific challenges posed by the Granite Hills climate, such as thermal expansion and contraction, which can lead to cracks if not properly addressed.

-

Choosing the Right Financing Option for Your Needs: Once you have a clear understanding of your roofing needs, the next step is to explore financing options. Whether you opt for a home equity loan, personal loan, or specialized roofing financing, it’s crucial to select a plan that aligns with your budget and long-term goals. We can guide you through the various options available, ensuring you make an informed decision that suits your financial situation.

-

Documentation Required for Roofing Finance Applications: Preparing the necessary documentation is vital for a smooth financing process. This typically includes proof of income, credit history, and details about the roofing project. Being familiar with local regulations and codes in Granite Hills can streamline this process, as we can assist you in gathering the required paperwork efficiently.

Maximizing Your Roofing Investment Through Financing

Financing your roofing project not only helps manage upfront costs but also opens the door to long-term benefits. By investing in a quality roof, you can enhance your home’s energy efficiency, which is particularly important in Granite Hills, where temperature fluctuations can impact energy consumption. Financing allows you to balance initial expenses with potential savings on energy bills, making it a smart choice for homeowners looking to maximize their investment.

In summary, navigating the roofing financing process in Granite Hills requires careful planning and consideration. With our local expertise and commitment to quality, Cal Roof is here to help you make the best financial decisions for your roofing needs.

Roofing Financing for Special Circumstances

When it comes to roofing needs in Granite Hills, CA, unexpected issues can arise at any moment. Whether it’s a sudden leak from a storm or damage from falling branches, emergency roof repairs can be both urgent and costly. At Cal Roof, we understand the stress that comes with these situations, which is why we offer quick financing solutions tailored for emergency roofing repairs. Our team is dedicated to assisting homeowners with urgent financing needs, ensuring that you can protect your home without the burden of immediate out-of-pocket expenses. With our flexible financing options, you can get the repairs you need promptly, safeguarding your property from further damage.

Financing Options for Historic Homes in Granite Hills

Granite Hills is home to many beautiful historic properties that require special care and consideration when it comes to roofing. Financing for heritage roofing projects can be complex, as it often involves compliance with local historic preservation guidelines. At Cal Roof, we are well-versed in these regulations and can guide you through the financing process while ensuring that your project meets all necessary standards.

Balancing authenticity and affordability is crucial for homeowners looking to restore their historic roofs. We work closely with local suppliers who specialize in materials that not only preserve the aesthetic integrity of your home but also fit within your budget. Our expertise in navigating the unique challenges of historic roofing projects in Granite Hills allows us to provide tailored financing solutions that respect both your financial needs and the architectural heritage of our community.

For more information on compliance with local historic preservation guidelines, please visit Compliance with local historic preservation guidelines.

Making an Informed Decision on Roofing Financing

When it comes to roofing projects in Granite Hills, CA, understanding your financing options is crucial. With the unique climate and local regulations affecting roofing materials and installation, choosing the right financing can significantly impact your overall project cost and satisfaction. At Cal Roof, we recognize that each homeowner’s financial situation is different, and we are here to guide you through the available roofing financing options tailored to our community.

Comparing Roofing Financing Options in Granite Hills

In Granite Hills, homeowners have several financing methods to consider. Traditional bank loans, home equity lines of credit (HELOCs), and specialized roofing financing programs are all viable options. When comparing these methods, it’s essential to evaluate interest rates, terms, and the total cost of ownership. For instance, while a HELOC may offer lower interest rates, it often requires substantial equity in your home. On the other hand, specialized roofing financing programs may provide flexible terms but could come with higher interest rates.

Understanding the nuances of these options can help you choose the best financing solution for your specific situation. For example, if you’re planning a new roof installation in the summer months, you might want to consider a financing option that allows for deferred payments until after the project is completed, giving you time to budget for your new roof.

Common Pitfalls to Avoid in Roofing Financing

Navigating roofing financing can be tricky, and there are common pitfalls to watch out for. One major red flag is the presence of hidden fees in financing agreements. Always read the fine print to understand the total cost of your loan, including any origination fees or penalties for early repayment. Additionally, be wary of predatory lending practices that may target homeowners in need of urgent repairs.

At Cal Roof, we emphasize transparency in all our financing discussions, ensuring you are fully informed before making a decision. Protecting yourself from unfavorable terms is essential, especially in a market like Granite Hills, where the demand for quality roofing services can sometimes lead to rushed decisions.

By taking the time to compare your options and understanding the potential pitfalls, you can make an informed decision that aligns with your financial goals and roofing needs.

The Cal Roof Advantage in Roofing Financing

At Cal Roof, we understand that investing in a new roof or a roof replacement is a significant financial decision for homeowners in Granite Hills, CA. Our commitment to transparent financing ensures that you are fully informed every step of the way. We believe that clear and honest financial communication is essential, especially in a community where local weather conditions can impact roofing needs. Whether it’s the intense summer heat or the occasional winter storms, we are here to help you navigate the financial aspects of your roofing project.

Our Commitment to Transparent Financing

Cal Roof prioritizes transparency in all our financial dealings. We take the time to explain every aspect of your financing options, ensuring that you understand the terms, interest rates, and payment schedules. Our goal is to help you find the best financial solution tailored to your specific project needs. We work closely with local financial institutions to provide you with competitive rates and flexible terms that suit your budget.

Personalized Financing Guidance for Granite Hills Homeowners

Every homeowner’s financial situation is unique, and at Cal Roof, we offer personalized one-on-one consultations to explore your financing options. Our experienced team will assess your roofing needs and provide tailored advice that aligns with your financial goals. Whether you are considering a new roof installation or a roof replacement, we are dedicated to supporting you throughout your roofing financing journey.

In Granite Hills, where local regulations and building codes can vary, having a knowledgeable partner like Cal Roof makes all the difference. We are committed to ensuring that your roofing project is not only financially feasible but also compliant with local standards. Trust us to guide you through the complexities of roofing financing, so you can focus on what matters most—protecting your home and family.

Sustainable Roofing and Financing in Granite Hills

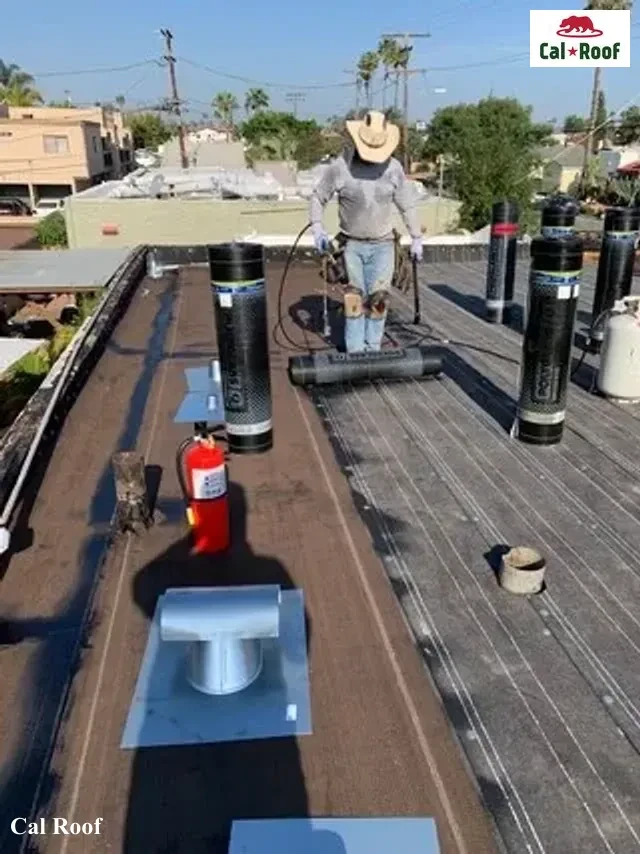

In Granite Hills, the push for sustainable living is not just a trend; it’s a necessity driven by our unique climate and environmental considerations. As a leading roofing contractor in the area, Cal Roof understands the importance of eco-friendly roofing solutions and the financial options available to homeowners looking to make the switch.

Green Roofing Financing Incentives

Granite Hills residents can take advantage of various local and state programs designed to support eco-friendly roofing initiatives. These programs often provide financial incentives for homeowners who choose sustainable materials, such as cool roofs or solar shingles, which are particularly beneficial in our sunny climate. By utilizing these financing options, homeowners can significantly reduce the upfront costs associated with installing green roofing systems.

Moreover, financing can make sustainable roofing more accessible to a broader audience. Many homeowners may hesitate to invest in energy-efficient roofing due to initial costs, but with the right financing plan, these investments become manageable. Local banks and credit unions often offer specialized loans tailored for energy-efficient home improvements, making it easier for residents to upgrade their roofs without financial strain.

Financing Energy-Efficient Roofing Upgrades

In addition to local incentives, there are special loans and rebates available specifically for energy-saving roof installations. These financial products are designed to encourage homeowners to invest in roofing solutions that not only enhance their property value but also contribute to long-term energy savings. For instance, installing a reflective roof can lower cooling costs during the hot summer months, which is a significant consideration for Granite Hills residents.

Calculating the return on investment (ROI) on financed green roofing projects is crucial. Homeowners can expect to see a reduction in their energy bills, which can offset the costs of financing over time. By investing in energy-efficient roofs, residents not only contribute to a healthier environment but also enjoy the financial benefits of reduced long-term costs. For more information on how energy-efficient roofs can reduce your long-term costs, check out this resource.

By choosing sustainable roofing options and utilizing available financing, Granite Hills homeowners can make a positive impact on both their finances and the environment.

Planning Your Roofing Project with Financing in Mind

When considering a roofing project in Granite Hills, CA, it’s essential to plan not just for the physical aspects of the installation but also for the financial implications. With the unique climate and local regulations affecting roofing choices, understanding how to budget and finance your project can make a significant difference in your overall experience.

Budgeting for Your Financed Roofing Project

Creating a comprehensive budget for your new roof involves more than just the cost of materials and labor. In Granite Hills, where the weather can lead to specific challenges such as thermal expansion and contraction, it’s crucial to factor in potential additional costs for high-quality materials that can withstand these conditions. When financing your roofing project, consider the interest rates and fees associated with your financing options. This will help you create a realistic budget that encompasses all aspects of the project, including financing costs.

Managing your finances during the roofing process is equally important. Keep track of all expenses and ensure that you have a contingency fund for unexpected costs, such as repairs for underlying issues that may arise once the old roof is removed. This proactive approach can help you avoid financial strain and ensure a smoother project.

Timeline Considerations for Financed Roofing Projects

Financing can also impact your roofing project schedule. In Granite Hills, where local building codes and weather conditions can affect installation timelines, it’s vital to coordinate your financing approval with your roofing installation dates. Delays in financing can lead to postponed projects, which may expose your home to the elements longer than necessary.

To ensure efficient project management with financed roofing, communicate openly with your contractor about your financing timeline. This will help align your project schedule with the necessary approvals and inspections, ensuring that your new roof is installed promptly and efficiently. By planning ahead and considering these factors, you can navigate the complexities of roofing financing in Granite Hills with confidence.

Expert Guidance on Roofing Services in Granite Hills, CA

When it comes to roofing services in Granite Hills, CA, Cal Roof stands out not only for our exceptional craftsmanship but also for our flexible financing options. We understand that investing in a new roof or a roof replacement can be a significant financial commitment, especially for homeowners in our community. That’s why we offer tailored financing solutions that make it easier for you to protect your home without breaking the bank.

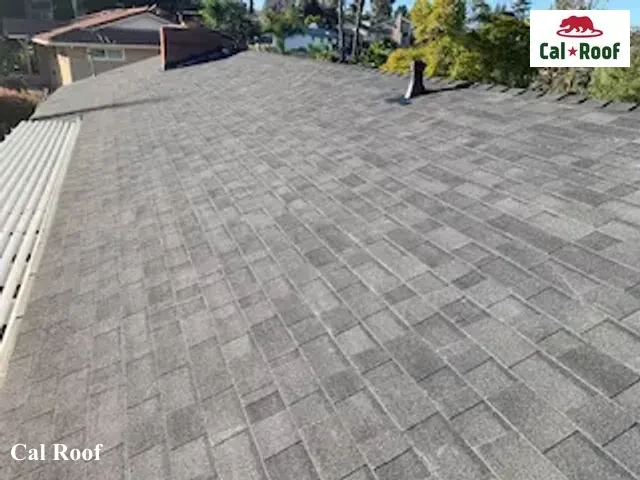

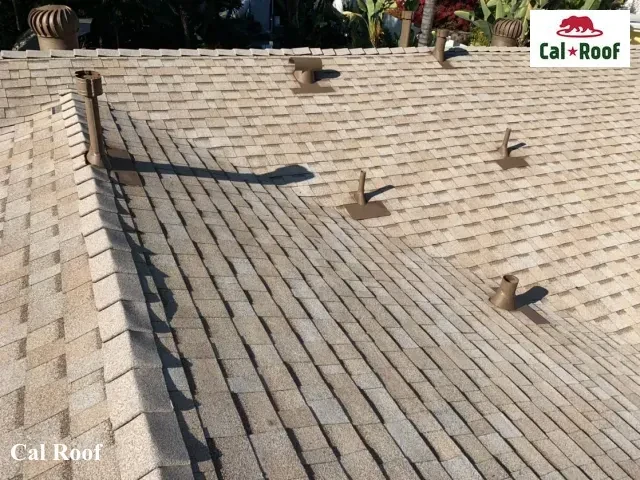

Granite Hills is known for its unique climate, which can pose specific challenges for roofing. The area experiences a mix of sunny days and occasional rain, leading to thermal expansion and contraction that can cause wear and tear on roofing materials. Choosing a reputable contractor like Cal Roof ensures that your roofing project is handled with the utmost care, utilizing materials that can withstand these local conditions. Our team is well-versed in the local building codes and regulations, ensuring that your roofing project meets all necessary standards while also providing you with peace of mind.

Moreover, financing your roofing project through a trusted contractor is crucial. It not only allows you to manage your budget effectively but also ensures that your investment is protected. At Cal Roof, we prioritize transparency and communication throughout the financing process, so you know exactly what to expect. Our experienced team is here to guide you through every step, from selecting the right roofing materials to understanding the financing options available to you.

By choosing Cal Roof, you’re not just getting a roof over your head; you’re making a smart investment in your home’s future. Let us help you navigate the complexities of roofing financing while delivering the quality service you deserve.