Roofing Financing Options in El Cajon, CA

Understanding Roofing Financing Options in El Cajon, CA

When it comes to maintaining the integrity of your home, timely roof repairs and replacements are crucial. In El Cajon, CA, where the climate can lead to wear and tear on roofing materials, addressing these needs promptly can prevent more significant issues down the line. However, budget constraints often pose a challenge for homeowners. This is where roofing financing options come into play, allowing you to preserve your home’s value while managing costs effectively.

Why Consider Financing for Your Roofing Project

Investing in your roof is not just about aesthetics; it’s about safeguarding your home against the elements. A well-maintained roof can significantly enhance your property’s value, especially in neighborhoods like Rancho San Diego and Fletcher Hills, where curb appeal is paramount. Financing solutions can help you tackle urgent repairs without the stress of immediate out-of-pocket expenses. By opting for financing, you can ensure that your roof is in top condition, preventing further damage that could lead to costly repairs in the future.

Types of Roofing Financing Available in El Cajon, CA

El Cajon residents have several roofing financing options tailored to meet their needs:

-

Home Equity Loans and Lines of Credit: These options allow you to leverage the equity in your home to fund your roofing project. Given the rising property values in El Cajon, this can be a viable solution for many homeowners.

-

Personal Loans for Roofing Projects: If you prefer a straightforward approach, personal loans can provide the necessary funds without tying them to your home’s equity. This option is particularly useful for smaller projects or urgent repairs.

-

Contractor-Offered Financing Programs: Many local contractors, including Cal Roof, offer financing programs that can simplify the process. These programs often come with competitive rates and flexible terms, making it easier for you to manage your budget.

-

Government-Backed Loan Options for El Cajon Residents: Various government programs are available to assist homeowners in financing essential home improvements. These loans often come with lower interest rates and favorable repayment terms, making them an attractive option for those in need.

By understanding these financing options, you can make informed decisions that align with your financial situation while ensuring your roof remains a protective barrier against El Cajon’s diverse weather conditions.

Navigating Roofing Financing Services in El Cajon, CA

When it comes to roofing projects in El Cajon, understanding your financing options is crucial. With the unique climate and architectural styles in our area, homeowners often face specific challenges that can impact their roofing needs and budget. At Cal Roof, we recognize that investing in a new roof or a replacement can be a significant financial decision, and we are here to guide you through the process.

Choosing the Right Financing Option for Your Roof

Before diving into financing, it’s essential to assess your financial situation and credit score. El Cajon residents should be aware that local lenders may offer tailored financing solutions that consider the unique aspects of our community. For instance, homes in neighborhoods like Rancho San Diego or Fletcher Hills may have different property values and equity considerations, which can influence your financing options.

Comparing interest rates and terms is another critical step. Local banks and credit unions often provide competitive rates for roofing projects, so it’s wise to shop around. Additionally, understanding how a new roof can impact your home’s equity is vital. A well-installed roof not only enhances curb appeal but can also increase your property value, making it a smart investment.

Working with Roofing Financing Contractors

One of the significant benefits of contractor-facilitated financing is the convenience it offers. At Cal Roof, we work closely with reputable financing partners to provide our clients with flexible options that suit their needs. This collaboration ensures that you can focus on your roofing project without the stress of navigating complex financing processes alone.

When selecting a roofing contractor that offers financing, it’s essential to vet their credentials. Look for contractors with a solid reputation in El Cajon, and ensure they are properly licensed and insured. The importance of proper licensing and permits cannot be overstated, as it protects you from potential legal issues and ensures that your roofing project meets local building codes.

By understanding your financing options and working with experienced contractors, you can make informed decisions that will lead to a successful roofing project in El Cajon.

El Cajon-Specific Roofing Financing Considerations

When it comes to roofing financing options in El Cajon, CA, understanding local regulations and climate considerations is crucial for homeowners. As a seasoned contractor with extensive experience in the area, I can provide insights that will help you navigate these aspects effectively.

Local Regulations and Financing

El Cajon has specific building permit requirements for roofing projects that can impact your financing options. Before starting any roofing work, it’s essential to familiarize yourself with the El Cajon building permit requirements for roofing projects. These regulations ensure that your roofing project complies with local codes, which can affect the overall cost and financing terms. For instance, if your project requires a permit, lenders may consider this when evaluating your financing application, as it adds to the total project cost.

Additionally, compliance with California roofing standards is vital. Understanding these standards can help you choose materials and designs that not only meet regulatory requirements but also enhance the longevity and efficiency of your roof. More information can be found in the Compliance with California roofing standards.

Climate Considerations for Roofing Financing in El Cajon, CA

El Cajon’s climate presents unique challenges that can influence your roofing choices and financing options. With the region’s warm, dry summers and occasional wildfire risks, investing in energy-efficient roofing solutions can be a smart financial decision. Many financing programs offer incentives for energy-efficient upgrades, which can lower your long-term energy costs.

Moreover, addressing wildfire concerns through your roofing choices is essential. Selecting materials that are fire-resistant can not only protect your home but may also qualify you for specific financing options aimed at enhancing safety. Incorporating defensible space in roofing projects is another consideration that can impact your financing. For more information on this topic, refer to Incorporating defensible space in roofing projects.

By understanding these local factors, you can make informed decisions about your roofing financing options, ensuring that your investment is both compliant and beneficial in the long run.

Maximizing Your Roofing Investment with Financing

When it comes to roofing projects in El Cajon, CA, financing options can significantly enhance your investment. With the unique climate challenges we face, such as intense sun exposure and occasional heavy rains, having a quality roof is essential. Financing allows homeowners to manage costs while ensuring they receive the best materials and professional installation.

Long-Term Benefits of Financed Roofing Projects

Investing in a new roof through financing not only alleviates immediate financial pressure but also offers long-term benefits. For instance, a well-installed roof can lead to substantial energy savings, especially when combined with energy-efficient materials that reflect heat, reducing cooling costs during our hot summers. Additionally, a new roof can increase your home’s value, making it a wise investment if you plan to sell in the future.

Moreover, financing options often come with extended warranties, ensuring that your investment is protected for years to come. This peace of mind is invaluable, especially in a region like El Cajon, where the weather can take a toll on roofing materials. Professional installation, backed by financing, guarantees that your roof is installed correctly, minimizing the risk of issues such as thermal expansion and contraction that can lead to cracks.

Combining Roofing Financing with Other Home Improvements

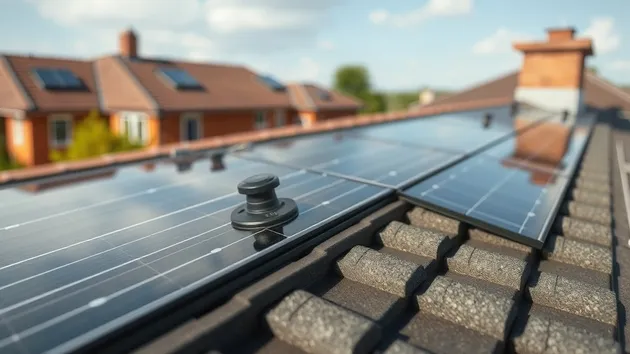

Financing your roofing project can also open doors to integrating other home improvements. For example, if you’re considering solar panel installation, combining it with a new roof can maximize your energy efficiency. The roof serves as the perfect foundation for solar panels, and financing can help you manage the costs of both projects simultaneously.

Additionally, upgrading your insulation while replacing your roof can further enhance energy efficiency, keeping your home comfortable year-round. Don’t forget about gutter system improvements; a new roof paired with an upgraded gutter system can prevent water damage and protect your home’s foundation, especially during El Cajon’s rainy seasons.

By leveraging roofing financing options, you can ensure that your home remains protected, energy-efficient, and valuable for years to come.

Government Programs for Roofing Financing in El Cajon, CA

When it comes to roofing financing options in El Cajon, homeowners have access to a variety of government programs designed to ease the financial burden of roof repairs and replacements. Understanding these options can help you make informed decisions about your roofing needs while ensuring compliance with local regulations and codes.

Federal Roofing Assistance Programs

For residents in El Cajon, several federal programs can provide financial assistance for roofing projects. One notable option is the USDA Rural Development loans and grants, which are available to low-income homeowners in rural areas. This program can help cover the costs of necessary repairs, including roofing, ensuring that your home remains safe and secure.

Additionally, the FHA Title I Home and Property Improvement Loans offer another avenue for financing. These loans are particularly beneficial for homeowners looking to improve their property value through essential upgrades, such as a new roof. Veterans can also take advantage of VA-backed home improvement loans, which provide favorable terms and conditions for those who have served in the military.

California State Roofing Finance Initiatives

In California, there are specific state programs tailored to assist homeowners in El Cajon. The CalHome Program for low-income homeowners is designed to provide financial aid for home repairs, including roofing projects. This program is especially beneficial for those who may struggle to afford necessary improvements.

Another option available in El Cajon is the PACE financing program, which allows homeowners to finance energy-efficient upgrades, including roofing, through their property taxes. This initiative not only helps with immediate costs but also promotes long-term energy savings.

Lastly, the California solar initiative offers rebates for roof-mounted solar systems, making it an attractive option for homeowners looking to enhance their roofing while investing in renewable energy. This can significantly reduce both roofing and energy costs, aligning with the state’s commitment to sustainability.

By leveraging these government programs, homeowners in El Cajon can find the financial support they need to address their roofing challenges effectively.

Preparing for Your Roofing Financing Application

When considering a roofing project in El Cajon, CA, understanding the financing options available to you is crucial. Whether you’re looking to install a new roof or replace an existing one, preparing for your roofing financing application can significantly impact your approval chances and the terms you receive.

Documentation Needed for Roofing Financing

To streamline your application process, gather the following essential documents:

-

Proof of income and employment verification: Lenders typically require recent pay stubs, tax returns, or bank statements to assess your financial stability. Given the local job market in El Cajon, showcasing consistent employment can strengthen your application.

-

Property value assessment and current mortgage information: Having an up-to-date appraisal of your home can help lenders understand your equity position. This is particularly important in neighborhoods like Rancho San Diego, where property values can fluctuate based on market trends.

-

Detailed roofing project estimates and plans: Providing a comprehensive estimate from a reputable contractor, such as Cal Roof, can demonstrate the seriousness of your project. This estimate should include materials, labor costs, and timelines, which can help lenders gauge the project’s scope.

Tips for Improving Your Chances of Approval

To enhance your likelihood of securing favorable financing, consider these strategies:

-

Boosting your credit score before applying: A higher credit score can lead to better interest rates and terms. In El Cajon, where many homeowners are looking to upgrade their roofs, taking steps to improve your credit can set you apart from other applicants.

-

Reducing existing debt-to-income ratio: Lenders often look at your debt-to-income ratio to assess your ability to repay new loans. Paying down existing debts can improve this ratio, making you a more attractive candidate for financing.

-

Gathering multiple quotes from roofing services in El Cajon, CA: Obtaining several estimates not only helps you find the best price but also provides lenders with a clearer picture of your project’s financial requirements. This can be particularly beneficial in a competitive market like El Cajon, where various roofing options are available.

By preparing thoroughly and understanding the local market dynamics, you can navigate the roofing financing process with confidence, ensuring that your project is both financially feasible and aligned with your home improvement goals.

Making the Most of Your Roofing Financing

When it comes to roofing projects in El Cajon, CA, understanding your financing options is crucial for a successful outcome. At Cal Roof, we recognize that budgeting for your roofing project involves more than just the initial quote. It’s essential to grasp the total cost of ownership, which includes not only the installation but also potential maintenance and repair costs down the line. Given the unique climate of El Cajon, where summer heat can lead to thermal expansion and contraction, it’s wise to invest in quality materials that can withstand these conditions. This approach not only enhances the longevity of your roof but also aligns with favorable financing terms that can ease your financial burden.

Budgeting for Your Roofing Project

Planning for unexpected expenses is a vital part of budgeting for your roof replacement. In El Cajon, unforeseen issues such as pest infestations or damage from seasonal storms can arise, necessitating additional funds. By setting aside a contingency budget, you can ensure that your project remains on track without financial strain. Balancing quality materials with financing terms is another critical aspect. While it may be tempting to opt for the lowest bid, investing in durable materials can save you money in the long run, especially in a region prone to weather fluctuations.

Timing Your Roofing Finance Application

Timing is everything when it comes to roofing finance applications. In El Cajon, seasonal considerations can significantly impact both the cost and availability of roofing services. For instance, many homeowners choose to undertake roofing projects in the spring or fall, which can lead to higher demand and potentially increased prices. However, taking advantage of off-season discounts can provide substantial savings. Aligning your financing application with contractor availability can also streamline the process, ensuring that you secure the best rates and terms for your roofing project.

By understanding these key aspects of roofing financing, you can make informed decisions that will benefit your home and your wallet in the long run.